Accounting

Program Details

Courses You May Take

ACCT1124: Financial Accounting

Credits: 4

ACCT2224: Managerial Accounting

Credits: 0-4

ACCT3453: Tax Accounting I

Credits: 3

See All Required Courses

Entrance Requirements

Required

- Algebra

Recommended

- Geometry

- Algebra 2

In accounting, you’ll recognize and apply key theories across business functions, practice professional communication, and strengthen your decision-making through real-world accounting challenges. You’ll also develop critical thinking in financial contexts and learn to identify and address ethical issues within the field. Together, these skills prepare you for immediate employment or continued study.

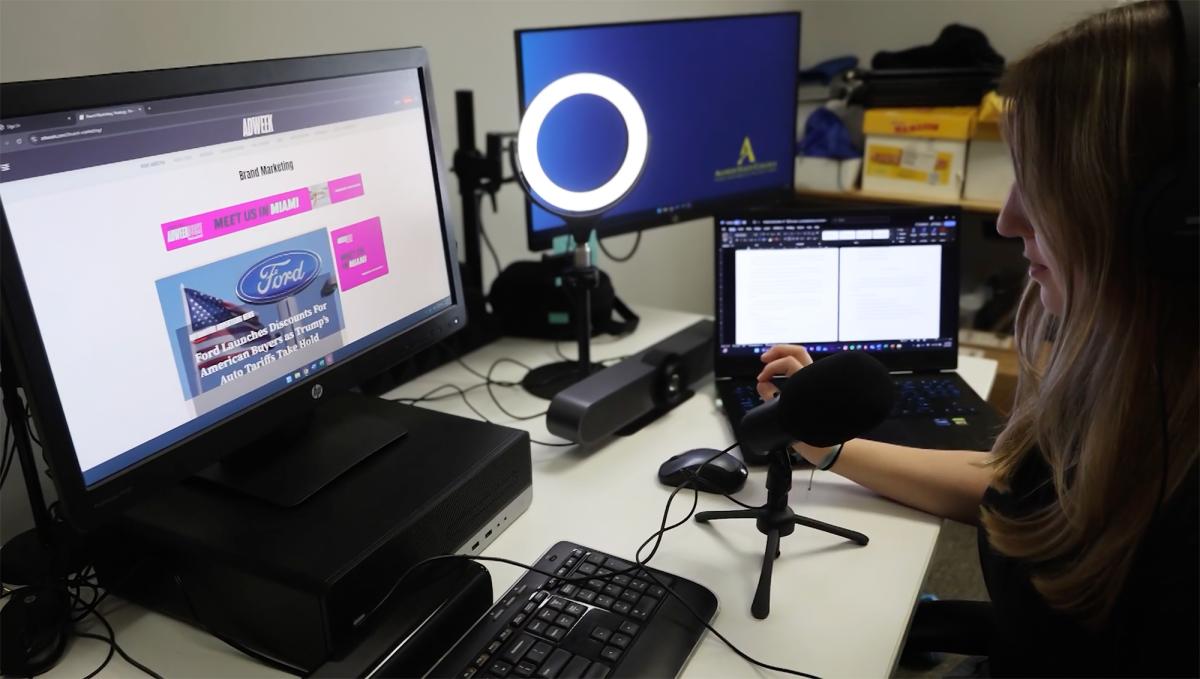

Facilities and Labs

Alfred State provides labs, equipment, and learning spaces that mirror the tools and technology used in the real world.

With 200+ labs on campus and experiential learning in every major, you’ll work with the same resources the pros use and be ready for the workplace on day one.

Wondering where your skills can take you? Our career tool lets you explore real job titles, key skills, salary ranges, and job outlook data from the US Bureau of Labor Statistics nationally or for New York State.

See how your Alfred State degree connects directly to in-demand careers and start planning your future with confidence.

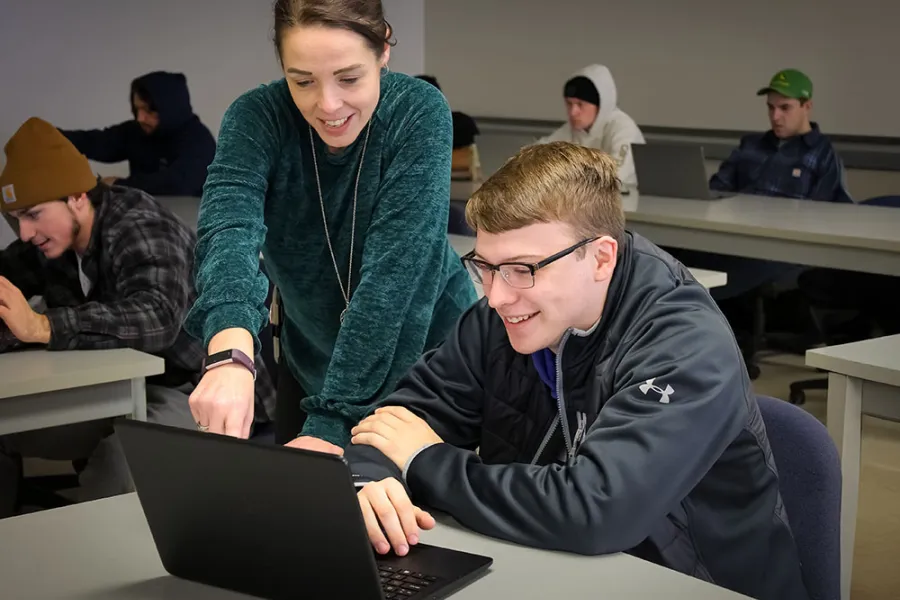

MEET OUR FACULTY

TAKE THE NEXT STEP

You've seen our wide variety of majors at Alfred State, our great faculty who help you build your skills, and that you can do it at an incredible low cost. Now's the time to become an Alfred State Pioneer.